What’s more, the complaint charges that Walmart’s failure to have a policy in place to spot fraudulent transfers – and when the company finally put a policy in place, its failure to follow its own procedures – greased the wheels for scammers. The upshot: Scammers had to go no further than their neighborhood Walmart to pick up the proceeds of their crimes. The FTC alleges that for years it was Walmart’s policy to issue payouts even in the case of suspicious money transfers. What was in it for Walmart? First, financial services drive retail sales, but Walmart also makes millions of dollars in fees from fraudulent transactions run through its financial services. According to the FTC, Walmart turned a blind eye to massive amounts of fraud perpetrated through its money transfer operations. You’ll want to read the complaint for details about the FTC’s allegations against Walmart, but it boils down to this. The FTC has been sounding the alarm about the role that money transfer operators play in the flimflam ecosystem, resulting in law enforcement actions against MoneyGram and Western Union for their failure to protect consumers who used their services.

#Move money from walmart moneyvault free

The criminal is often home free while the consumer is left high and dry.

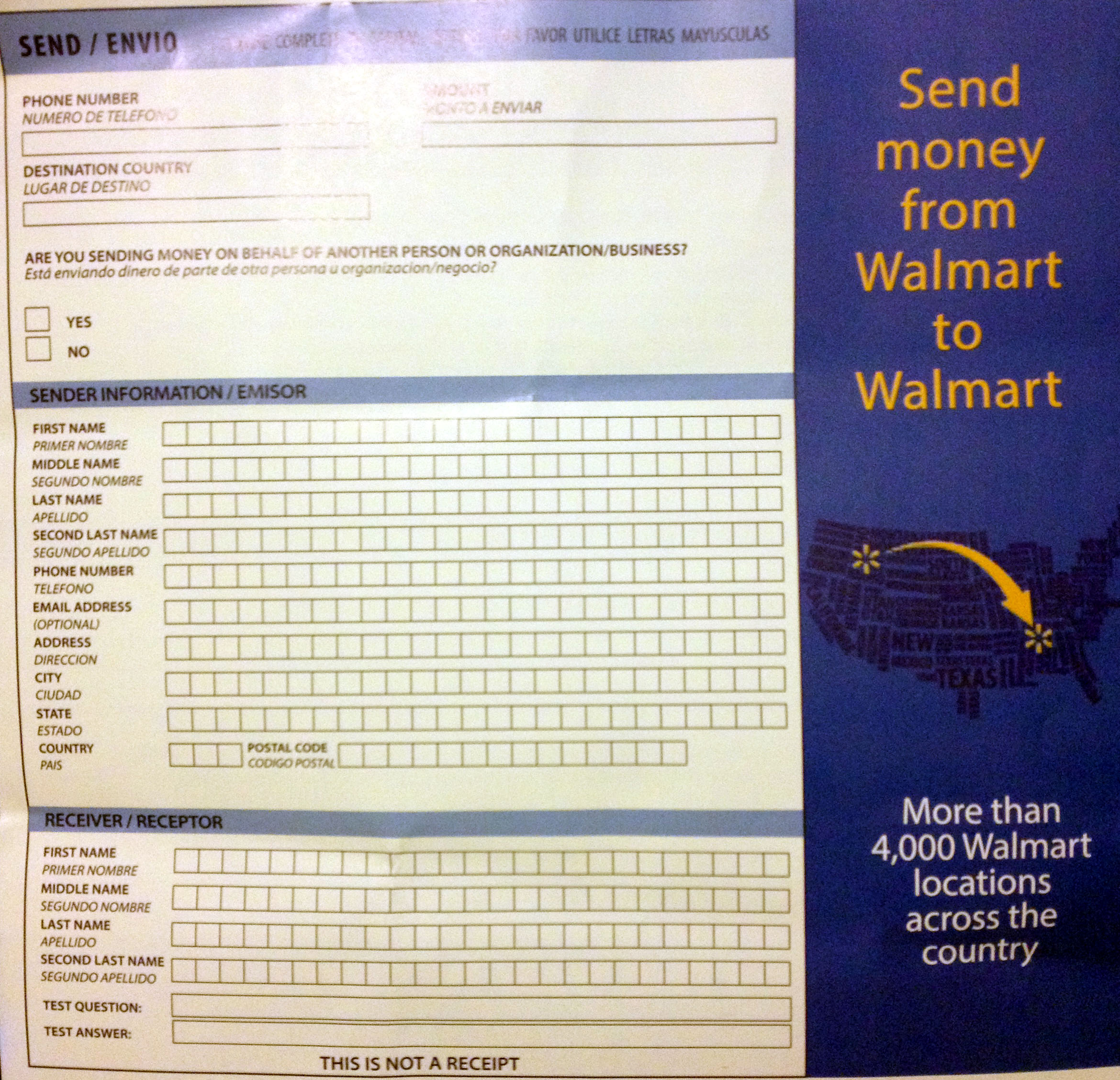

Once a transfer has been picked up, the transaction is almost impossible to reverse. There is a good reason why money transfers are a pet payment method for fraudsters. Walmart acts as an agent for multiple money transfer services, including MoneyGram, Ria and Western Union, and offers services under its Walmart2Walmart and Walmart2World brands. In addition to its retail business, Walmart runs a thriving operation as a financial services provider. According to the FTC, that’s where Walmart’s money transfer services come in. I’ve been arrested!” rip-offs, the transfer of money is the lifeblood of con artists – and they depend on a seamless way to convert their cons into cold cash. Whether it’s an IRS impersonation scam, a sweepstakes fraud, or one of those “Help, Grandma.

The FTC lawsuit charges that Walmart’s practice of looking the other way in the face of massive fraud and illegal telemarketing transactions violates the law. According to a complaint filed by the FTC, among the people who have come to rely on Walmart for their day-to-day needs are fraudsters who have allegedly used the retail giant’s money transfer services to bilk consumers out of millions of dollars. Millions of Americans look to Walmart as their go-to place to pick up essentials. About the FTC Show/hide About the FTC menu items.News and Events Show/hide News and Events menu items.Advice and Guidance Show/hide Advice and Guidance menu items.Competition and Consumer Protection Guidance Documents.Enforcement Show/hide Enforcement menu items.

0 kommentar(er)

0 kommentar(er)